Real Property Assessments

The California Constitution requires that all property be taxed, unless otherwise exempted under the California Constitution or United States Constitution. Article XIII-A of the California Constitution requires that real property only be reappraised when property undergoes a change in ownership or has new construction (see Proposition 13).

Assessment Roll Values

Your tax bill shows land and improvement values. "Improvements" include buildings or anything structural such as swimming pools or paving. When you have an improvement value, it doesn't always mean that you have recently improved your property.

Assessments are made for a fiscal year that runs from July 1 to June 30 the following year. The values on the assessment roll are for the property as of January 1 of the calendar year that the fiscal year starts. This is called the lien date. As an example:

- Fiscal Year 2024-2025 runs from July 1, 2024 to June 30, 2025.

- The assessed value on this tax bill is for the ownership and condition of the property as of January 1, 2024.

Supplemental Assessments

Supplemental Assessments pick up changes in assessed value, either increases or decreases, that occur in the middle of a fiscal year. Taxes based on these value changes are prorated from the time of the change to the end of the fiscal year. A Supplemental Assessment can be created due to new construction such as adding a pool or garage, or a change in ownership. The Supplemental bill is in addition to the regular tax bill.

Proposition 13

Proposition 13 requires all real property to be assessed at its Fair Market Value. Fair Market Value is the amount of cash the property would bring if sold on the open market under conditions in which neither buyer or seller could take advantage of the other. Both the buyer and the seller know of all of the uses of the property and restrictions on it. The price paid in a transaction is presumed to be the fair market value unless it is established by a preponderance of evidence that the property would not have transferred for that purchase price in an open market transaction.

This value is then referred to as the Base Year Value. The assessed value is the Base Year Value plus no more than 2 percent inflation per year, based on the California Consumer Price Index. This is called the Factored Base Year Value. The assessed value may be reduced by Proposition 8 if the Fair Market Value is lower than the Factored Base Year Value.

You have the right to appeal the value if you do not agree with it.

When is property reassessed?

-

New Construction

Copies of all building permits are sent to the Assessor's Office by the cities and county. New buildings, improvements to land, or alterations to existing buildings (such as a room addition) and land that constitute a major rehabilitation or convert the property to a different use require a reappraisal. If the construction is a replacement (such as a new roof), an appraisal may not be required. Construction in progress is also assessable.

-

Change of Ownership

When a transfer is filed with the Recorder's Office, the Assessor determines whether a reappraisal is necessary. If it is required, an appraisal is made to determine the new Fair Market Value of the property. The owner is then notified of the new assessment. Some transfers may be excluded from reassessment.

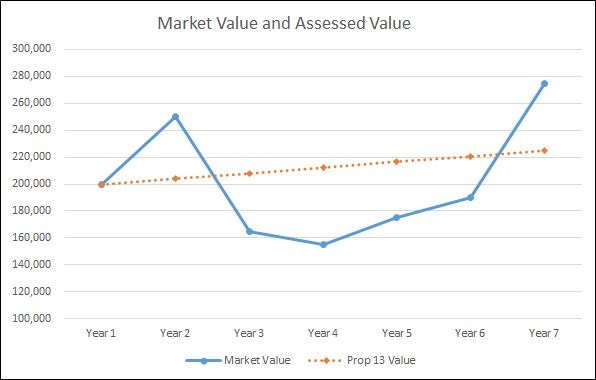

Proposition 8

Sometimes the market value of a property falls below its Proposition 13 value. Proposition 8 addresses these declines by allowing the Assessor to reduce the assessed value of your property by enrolling the temporary decline in fair market value. Once reduced, your property's value is reviewed each year to compare its current market value to its Proposition 13 value, then using the lower of the two. Proposition 8 values can change from year to year as the market fluctuates.

While your Proposition 13 value may increase a maximum of 2 percent per year, there is no limitation on the Proposition 8 value. Your new assessed value may have risen more than 2 percent over last year's value. However, your assessment can never exceed your factored base year value under Proposition 13. Once the market value is higher than the Proposition 13 value, the Assessor will restore the Proposition 13 value as the assessed value.

Assessed Value Affected by Proposition 8

| Year 1 |

$200,000 purchase price (market value) enrolled as assessed value |

| Year 2 |

Market value is higher than Proposition 13 value. Enrolled value is $204,000. |

| Year 3 |

Market value is lower than Proposition 13 value. Enrolled value is $165,000 per Proposition 8. |

| Year 4 |

Market value is lower than Proposition 13 value. Enrolled value is $155,000 per Proposition 8. |

| Year 5 |

Market value is lower than Proposition 13 value. Enrolled value is $175,000 per Proposition 8. |

| Year 6 |

Market value is lower than Proposition 13 value. Enrolled value is $190,000 per Proposition 8. |

| Year 7 |

Market value is higher than Proposition 13 value. The Assessor enrolls the lower Proposition 13 value of approximately $225,200. |

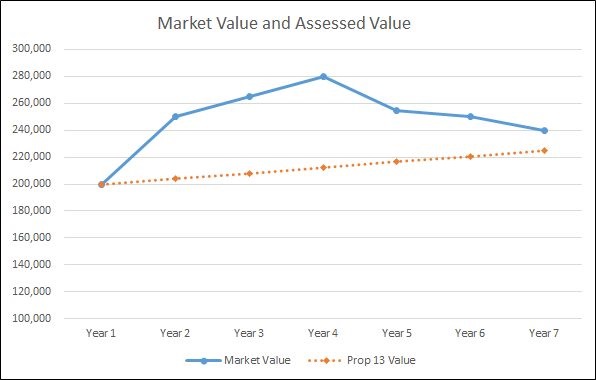

Assessed Value Not Affected by Proposition 8

| Year 1 |

$200,000 purchase price (market value) enrolled as assessed value |

| Year 2 |

Market value is higher than Proposition 13 value. Enrolled value is $204,000, the prior year plus 2%. |

| Year 3 |

Market value is higher than Proposition 13 value. Enrolled value is approximately $208,000. |

| Year 4 |

Market value is higher than Proposition 13 value. Enrolled value is approximately $212,000. |

| Year 5 |

Market value is less than prior years, but still higher than the Proposition 13 value. Enrolled value is approximately $216,400. |

| Year 6 |

Market value is still higher than Proposition 13 value. Enrolled value is approximately $220,800. |

| Year 7 |

Market value is still higher than Proposition 13 value. Enrolled value is approximately $225,200. |

Unlike the first example, the market value never drops below the Proposition 13 assessed value. No adjustment is necessary.

Mobile Homes

Manufactured Housing is the official name for what we refer to as mobile homes. The registration, licensing and assessment of these is more complicated than licensed vehicles or for other properties assessed by the county. If installed on a legally recognized permanent foundation, they are treated as if they are no longer mobile homes for property tax purposes .

The State of California Department of Housing and Community Development (HCD) administers all mobile home registration and titling. In order to buy or sell a pre-owned unit, you should contact HCD to find out exactly what paperwork must be completed to make the transfer complete.

In addition to their paperwork, HCD also requires a Tax Clearance Certificate from the Tax Collector of the county where it is located. This Certificate proves to HCD that as of the date of issuance, all current taxes have been paid. Estimated or known taxes for the following fiscal year may also need to be collected during certain times of the year before a Tax Clearance Certificate can be issued.

If any portion of the necessary paperwork does not get submitted to HCD, the title cannot be updated. After HCD has processed the transfer, the Assessor's Office will be notified to change the ownership record on the assessment roll. Only after notification is received is the name changed on the assessment roll and tax bill. If it does not get transferred into your name, there will be difficulties if you try to sell or transfer it in the future.